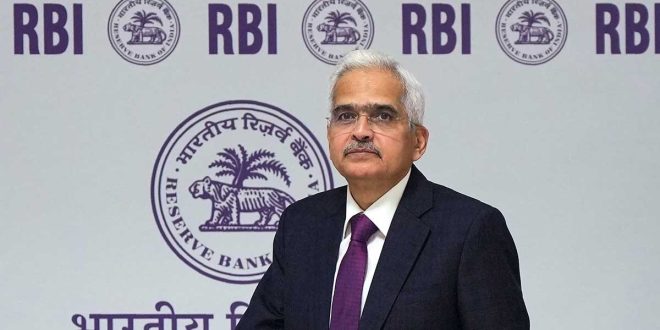

The Monetary Policy Committee (MPC) meeting was held between 4 and 6 December 2024. In which the economy was reviewed and important decisions were announced. The three-day MPC meeting was attended by Reserve Bank of India (RBI) Governor Shaktikanta Das, RBI Deputy Governor Michael Debabrata Patra, RBI Executive Director Rajiv Ranjan, Delhi School of Economics Director Ram Singh, economist Saugata Bhattacharya and Institute for Industrial Development Studies Director and Chief Executive Nagesh Kumar. Let us know what important things came out of the MPC meeting.

What did the RBI Governor say on repo rate?

- Monetary Policy Decision The policy repo rate under the liquidity adjustment facility (LAF) remains unchanged at 6.50%.

- The Standing Deposit Facility (SDF) rate remains at 6.25%. The Marginal Standing Facility (MSF) rate and the Bank Rate remain steady at 6.75%.

- The last change in repo rates was made in February 2023. It has been kept unchanged from April 2023 till now.

- There is no change in the repo rate and you will not get any relief on your home loan EMI for now. You will have to pay the same amount you were paying for now.

- Once again, the MPC decided to maintain a neutral monetary policy stance, aimed at keeping inflation under control while promoting growth.

- The RBI target is to achieve 4% CPI inflation rate (with a margin of ±2%) over the medium term, thereby ensuring both price stability and economic growth.

Uproar in Rajya Sabha over recovery of cash from member’s seat

What did Shaktikanta Das say on economy and growth rate?

- The RBI said the global economy is stable but growing at a slower pace and inflation is moderating. Geopolitical risks and trade policy uncertainties are creating greater volatility in global financial markets.

- In India, the GDP growth rate in the second quarter of 2024-25 was lower than expected at 5.4%, mainly due to a slowdown in private consumption and investment, although government spending improved during this period.

- Services and agriculture sectors showed resilience, but weak industrial activity (manufacturing, electricity, mining) impacted overall growth.

- Good Kharif production, better Rabi prospects, improving industrial activity and strong services sector are giving positive signals about the economy.

- Real GDP growth rate is projected at 6.6% for 2024-25. The growth rate is estimated to be 6.8% in the third quarter of the current financial year and 7.2% in the fourth quarter.

- The growth rate has been estimated at 6.9% in the first quarter of the first half of the financial year 2025-26 and 7.3% in the second quarter.

Uttarakhand Police to keep vigil on restaurants and roadside eateries

What did the RBI Governor say on inflation?

- CPI inflation rose to 6.2% in October, exceeding the upper target level given by the government to the RBI, due to higher food prices.

- According to RBI, inflation rate is expected to decline in the fourth quarter due to fall in prices of seasonal vegetables and good condition of Kharif and Rabi crops.

- These include adverse weather, rising global agricultural prices, and potential increases in energy costs, according to the MPC.

- Inflation is projected to be 4.8% in the financial year 2024-25. It is projected to be 5.7% in the third quarter, 4.5% in the fourth quarter and 4.6% in the first quarter of the first half of 2025-26 and 4.0% in the second quarter.

- Risks are balanced on both growth and inflation fronts.

CRR cut by 50 basis points

- The MPC announced a cut in the cash reserve ratio (CRR) by 50 basis points, bringing it down to 4%.

- CRR is that part of the bank’s deposits, which must be kept with the RBI as reserve fund under all circumstances.

RBI governor made this announcement to increase foreign capital inflow

- RBI announced an increase in the maximum limit of interest rate on FCNR-B deposits with immediate effect. The move is aimed at promoting foreign capital inflows into India with higher FCNR deposit rates.

- Foreign portfolio investment (FPI) flows into emerging market economies (EMEs) generally declined in October. India has received net FPI inflows of $9.3 billion so far in FY25.

What do MPC’s decisions mean?

- The RBI said that recent outcomes of inflation and growth in India have become less favourable since October.

- Better business and consumer sentiments reflected in RBI surveys are expected to improve economic activity.

- Inflation risks remain significant due to geopolitical uncertainties and market volatility.

- High inflation affects consumer purchasing power, especially in rural and urban areas, and hurts private consumption.

- Durable price stability is crucial for long-term high growth, which is why the MPC has kept the repo rate unchanged at 6.50%.

- The MPC maintained a neutral stance, maintaining flexibility to focus on inflation and growth as needed.

What was the stand of APC members on repo rate

- RBI governors Shaktikanta Das, Saugata Bhattacharya, Rajiv Ranjan, Michael Debabrata Patra voted in favour of keeping repo rates steady.

- APC members Nagesh Kumar Singh and Ram Singh voted in favour of reducing rates by 25 basis points. All members unanimously supported continuation of the neutral monetary policy stance.

What else special came out of the last MPC meeting of the year?

- RBI launched a tool called Mule-Hunter AI to detect and prevent mule accounts.

- RBI introduced podcasts as a new medium to communicate with the public.

- The next MPC meeting is scheduled for February 5-7, 2025.

Indian Thought Latest News & Views

Indian Thought Latest News & Views