New Delhi. Adani Enterprises has announced the cancellation of its follow-on public offering of Rs 20,000 crore. While announcing this late on Wednesday night, the company said that it will return all the money to the investors of this FPO.

Adani Group has taken this step at a time when the company is under the scanner due to the report of American short seller Hindenburg Research. In this report of Hindenburg Research, the company has been accused of using tax havens while mentioning huge debts.

Adani Group said in an exchange filing, ‘The Board of Directors of the company, in its meeting held today i.e. February 1, 2023, has approved, in the interest of its constituents, to issue debentures of up to Rs 20,000 crore each with a face value of Re 1 on a partially paid-up basis. It has been decided not to go ahead with the FPO of equity shares.

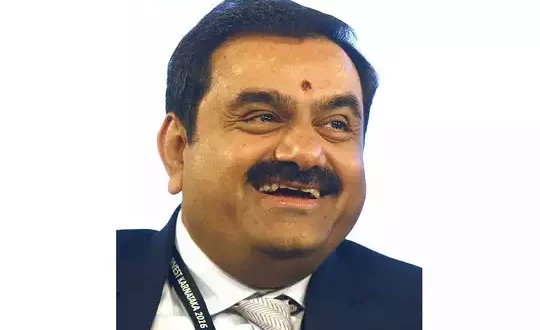

Gautam Adani, chairman of Adani Enterprises, issued a statement on Wednesday night saying that the decision was taken amid volatility in the group’s shares during the day’s trading. Gautam Adani said in his statement, ‘The board takes this opportunity to thank all investors for your support and commitment to our FPO. Subscription for FPO closed successfully yesterday. Despite the volatility in the stock during the past week, your faith and confidence in the company, its business and its management has been extremely reassuring and humble. Thank you.’

Gautam Adani further said in his statement, ‘However, today the market has been unprecedented and fluctuations in the price of our shares were seen during the day. In view of these extraordinary circumstances, the Board of the Company felt that it would not be ethically correct to go ahead with this FPO. The interests of the investors are paramount and hence to protect them from any possible financial loss, the Board has decided not to go ahead with the FPO.

Indian Thought Latest News & Views

Indian Thought Latest News & Views